Title: Arabian Express Cards: Enabling Seamless Payments in Your Local Currency

The Arab region, known for its diverse cultures and dynamic economies, is on the verge of a financial transformation with the launch of MoneyPoolsCash’s Arabian Express Cards. These region-specific payment cards are crafted to elevate the digital payment experience for consumers, businesses, and government institutions alike. Each card is pegged to USD stable tokens, providing the security and stability users desire, while offering the convenience of transacting in local currencies. Let’s explore the features of the Arabian Express Cards across the countries we support:

1. Saudi Arabia: Saudi Riyal (SAR)

The Arabian Express Card for Saudi Riyal allows users and merchants to engage in seamless transactions within the Kingdom. With a thriving e-commerce scene and a growing push towards digital payments, this card streamlines quick, secure transactions—empowering local businesses and encouraging consumers to adopt cashless payments.

2. United Arab Emirates: UAE Dirham (AED)

In the UAE—an innovation hub—the Arabian Express Card in AED provides individuals and corporations the freedom to transact without the hassles of currency conversion. With a booming tourism sector and a large expatriate community, this card ensures easy access to funds and facilitates spending across the country, supporting the UAE’s forward-looking digital economy.

3. Jordan: Jordanian Dinar (JOD)

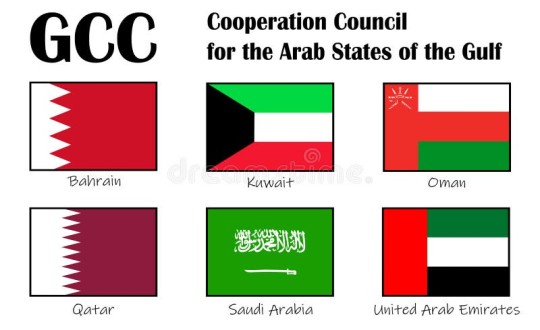

For Jordanian users, the Arabian Express Card pegged to the Jordanian Dinar arrives at an ideal time. It promotes local commerce, streamlines cross-border transactions within the Gulf Cooperation Council (GCC), and bolsters Jordan’s emerging fintech ecosystem—making payments simpler for both consumers and SMEs.

4. Bahrain: Bahraini Dinar (BHD)

As Bahrain advances toward becoming a regional financial hub, the Arabian Express Card in Bahraini Dinar offers fast, reliable payment solutions that support local enterprises. This card empowers Bahrainis to back their homegrown businesses while enjoying smooth, hassle-free transactions.

5. Oman: Omani Rial (OMR)

With a strategic focus on digitalizing its economy, Oman welcomes the Arabian Express Card in Omani Rial. It simplifies everyday transactions for consumers and businesses alike, and enhances cross-border e-commerce opportunities. The peg to USD stable tokens provides stability and fosters confidence in digital payments.

6. Kuwait: Kuwaiti Dinar (KWD)

The Arabian Express Card in KWD offers Kuwaitis a seamless way to handle both personal and business transactions. As digital solutions become more prevalent across sectors, this card gives local businesses a competitive advantage to thrive in the digital age.

The deployment of Arabian Express Cards marks a significant milestone in advancing financial inclusion and strengthening local economies throughout the Arab world. By providing tailored payment solutions, MoneyPoolsCash enables users to transact confidently in their native currencies. Whether you’re a consumer, merchant, or government entity, our Arabian Express Cards are designed to meet your specific needs and support the ongoing financial evolution in the region.

Stay tuned for upcoming updates—get ready to embrace the future of payments with MoneyPoolsCash!